The Taiwan election was on 2024-01-13 Saturday. It was recognized to be an event which would / could affect the investment market relating to Taiwan, and could even affect the economy worldwide as a whole due to the importance of Taiwan in the semiconductor industry. There are definitely a lot of hidden activities going on especially between the China and US government, and no doubts also between the huge investment market. This article was written on 2024-01-20 after the election.

It came to the following questions before the election:

- Are there any existing investments which are tied to this incidence that should be taken care of because of the possible unexpected disastrous results to the investments.

- Is this going to be a disaster in terms of investments, or equally also an opportunity. Is the opportunity worth for the risks? Are there ways to control or minimize the risks?

- If decision is made to take the opportunity, what options are there? What would you buy? Would you buy before or after the election? What do you know about the Taiwan market?

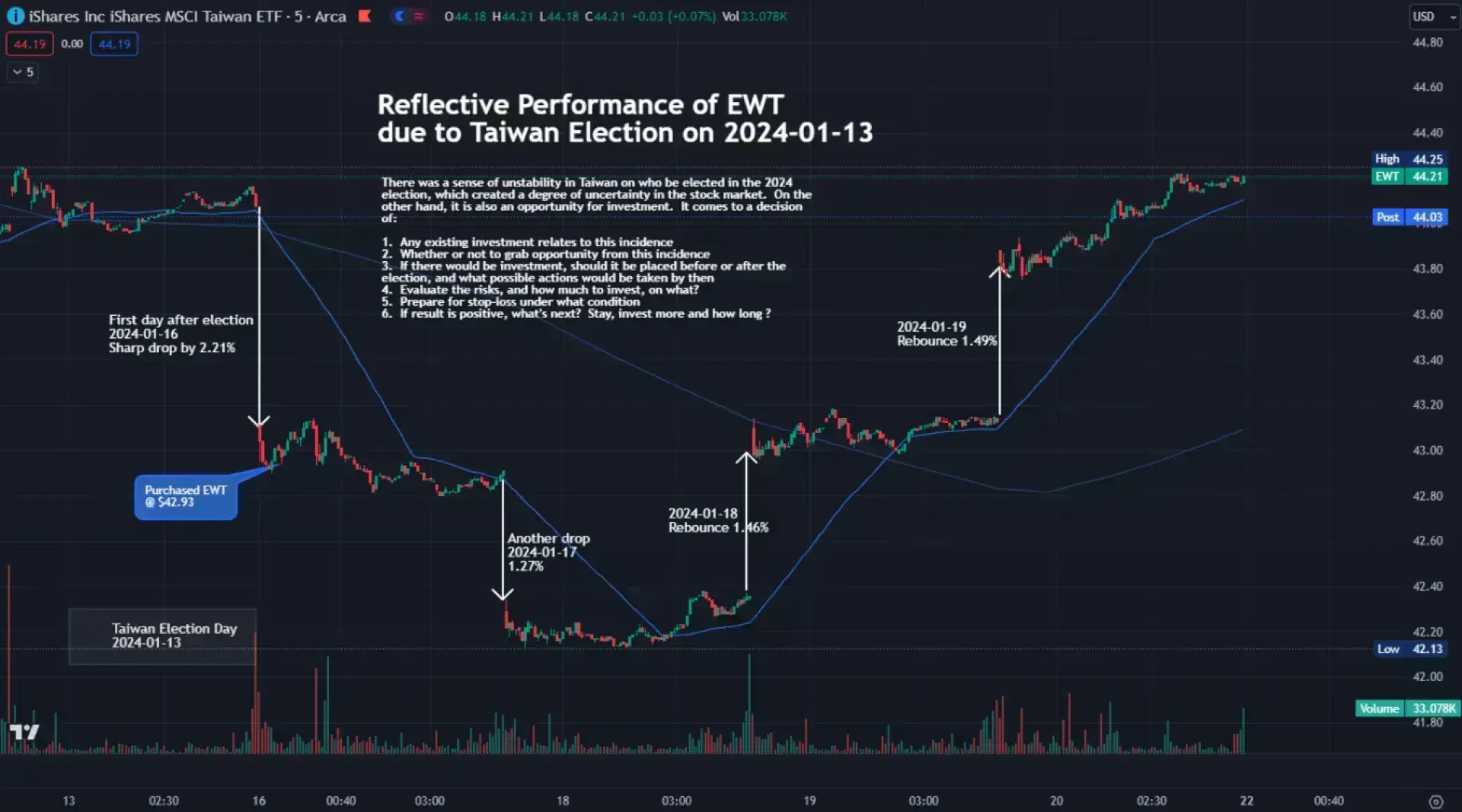

The author does not know too much about the Taiwan market. One of the background news months ago back in 2023 was the withdrawal of Warren Buffet's investment in Taiwan but soon after withdrew. It was speculated that it was the risks due to possibility of wars in upcoming future. The only tools of investment that the author knew of are a few of Taiwan ETF and TSM. TSM was on the high side in the market, and therefore the final decision was on EWT, a ETF tracking the Taiwan stock market performance. Let's look at the following chart as of 2024-01-20, the first week after the Taiwan Election.

The following was the thoughts of the author and the corresponding results:

| 2024-01-12 Investment was made after the election | To avoid the high risks of uncertainties and black swan effect. Invest before the election probably led to a higher return but also higher risks. After the election, there could still be rooms for grow for some time therefore we can observe what would happen after the market re-open after the election result is confirmed. This also meant to delay decision until the next transaction day the week after. No decision was made as far. |

| 2024-01-16 decision was made to place investment on EWT |

Investment decision was made on EWT in the US market, which is the evening of 2024-01-16 Monday. TSM was still on the high side, and it had been the focus of investment due to its role in the Technology segment. There was not much movement in the market. On the other hand, EWT dropped 2.21% and to the author it was taken as a good opportunity and bought @ $42.93. No doubts, there was still risks and uncertainty. To limit the risks, amount of investment was kept to minimum. |

| 2024-01-17 observation | EWT dropped further by around 1.27%. It was a bit disappointed but the author still hold on to it. No action was taken. Part of the reason was that the price bought was at a very good level according to short term history. |

| 2024-01-18 back up | There was a gap-up right at start of the day in the US market. It went back to the $43 level. It recovered the previous down-trend loss. |

| 2024-01-19 gap up |

There was another gap-up by 1.49% right at the start. Before the US market started, it was envisioned that EWT will go further up during the day. Decision was made to buy more on short-term day trade. Further buy were made @ 43.88 & 43.76. Eventually it went up above $44. The short-term buy were levelled same day with a small day-trade profit. It was envisioned that EWT will rise up to around $44.20, which represented a 2.96% profit. It came to a question whether or not to sell it at this target price. Finall decision was to retain it with the expectation for it to return to its normal range around $45-$46. In addition, additional buys could be possible as far as it stays in the $43 range. |

This article records the transaction history of EWT as a result of the Taiwan Election creating such an opportunity, together with the thougths and reasoning and how decisions were made. This is a material for review, reflection and for learning.

- Log in to post comments